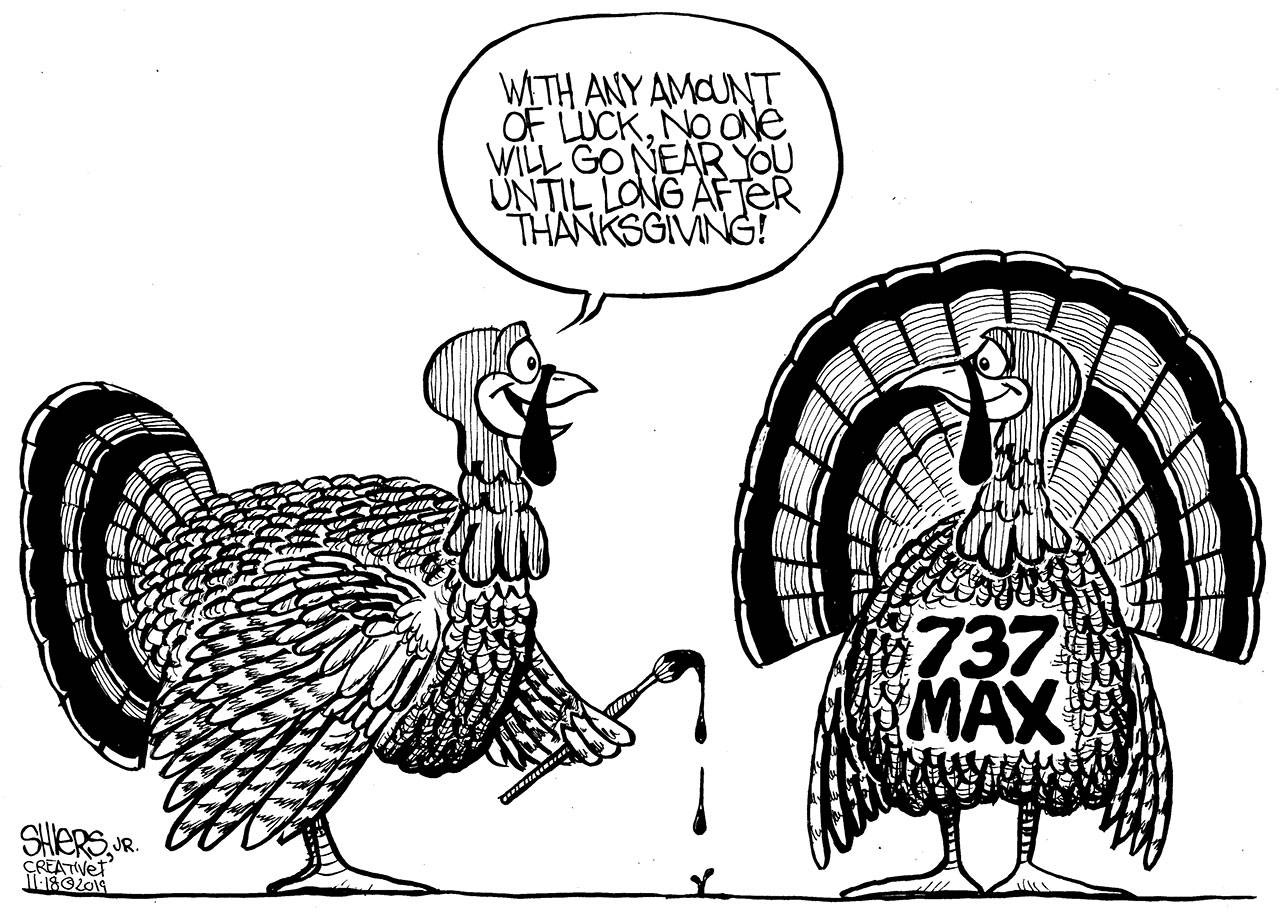

The grounding of the 737MAX is testing Boeing’s resiliency. It has turned the company upside down in just six months. Boeing executives and engineers have been under duress ever since the two fatal crashes that killed 346 people in Indonesia and Ethiopia, and that duress is likely to extend well into 2020.

What started as a continuation of a most successful 2018 for Boeing has turned into a prolonged migraine. Hopefully, the world’s most successful aerospace company will weather the storm and quickly convince airlines and passengers the MAX is safe to fly. But the overriding issue is safety.

The MAX is assembled at the Renton plant where production rates have been cut to 42 a month. Meanwhile, the number of finished, but undelivered, airplanes continues to grow.

The company’s financials are stretched.

“For the airplane’s manufacturer, it’s all getting very, very, very expensive. In the third quarter of 2019, according to an earnings report (Oct. 23), the plane’s continued grounding cost Boeing $900 million, bringing the total to $9.2 billion,” according the online business news site Quartz.

Until this year, the 737 production line had supplied the cash to develop large aircraft and pay shareholder dividends. Now, it is wide-body sales propping up the 737.

“Boeing spends roughly $3 billion a quarter to face debt payments and the dividend that has helped retain investors through the crisis,” Wall Street Journal’s Jon Sindreu reported earlier this month.

“But producing MAX jets without selling them is creating a quarterly cash drain. Offsetting this, wide-body planes – the 747, 767, 777 and 787 – are bringing in almost $3.7 billion a quarter in delivery payments, Dhierin-Perkash Bechai at AeroAnalysis estimates,” Sindreu added.

Until the Federal Aviation Administration (FAA) and other government regulators around the world approve Boeing’s safety modifications, the aircraft will not return to service. There are about 500 grounded 737 Max jets around the world, Bloomberg noted, with about 100 stuck at Boeing’s Renton plant.

Safety is paramount.

The software system named MCAS (Maneuvering Characteristics Augmentation System) which adjusts the pitch of the aircraft immediately after takeoff has been redesign and tested extensively. A second outside sensor and redundant systems have been added. Additional pilot training modules have been developed and airlines are sending pilots to flight simulators.

Hopefully, it all will work and airlines can phase the MAX back into service. U.S. based carriers Southwest, American and United aren’t scheduling 737MAX flights until at least next March. Meanwhile, the service disruption costs are mounting by the millions.

Boeing has had its share of mega-challenges before and survived.

For example, on Oct. 30, 1935, it was demonstrating the new B-17 to the U.S. Army Air Corps brass. The flight was part of Boeing’s bid to win the bomber contract.

The airplane, Model 299, was being flight tested by the Army Air Corps at Wright Field, near Dayton, Ohio. Shortly after takeoff, the “Flying Fortress” took a nose dive into the ground killing the pilot and test pilot and injuring several others on board. The pilot in command was an Air Corps officer. A Boeing test pilot was aboard as an observer and died of his injuries.

The investigation later determined the experienced pilot simply forgot to release the flight control gust locks. Boeing responded by mandating pilots to use of checklists from takeoff to landing. Using checklists is still required of pilots.

That crash nearly bankrupted Boeing; however, the company survived to build nearly 7,000 B-17s at Boeing Field alone.

The MAX stakes are high for Boeing.

Aircraft manufacturers project the world’s airlines will require 36,770 new planes by 2033. The market value is $5.2 trillion. The strongest growth is in the single-aisle market where three out of four new aircraft are anticipated. That’s where Boeing and Airbus really bump heads and that market is attracting new competitors from Japan, Russia, Canada, Brazil and China.

Hopefully, Boeing’s resiliency pays off again.

Don C. Brunell is a business analyst, writer and columnist. He retired as president of the Association of Washington Business, the state’s oldest and largest business organization, and now lives in Vancouver. He can be contacted at theBrunells@msn.com.

Talk to us

Please share your story tips by emailing editor@kentreporter.com.

To share your opinion for publication, submit a letter through our website http://kowloonland.com.hk/?big=submit-letter/. Include your name, address and daytime phone number. (We’ll only publish your name and hometown.) Please keep letters to 300 words or less.