Property taxes in the city of Kent will jump about 15.4 percent this year, primarily due to additional taxes passed by the state Legislature to increase funding for K-12 basic education.

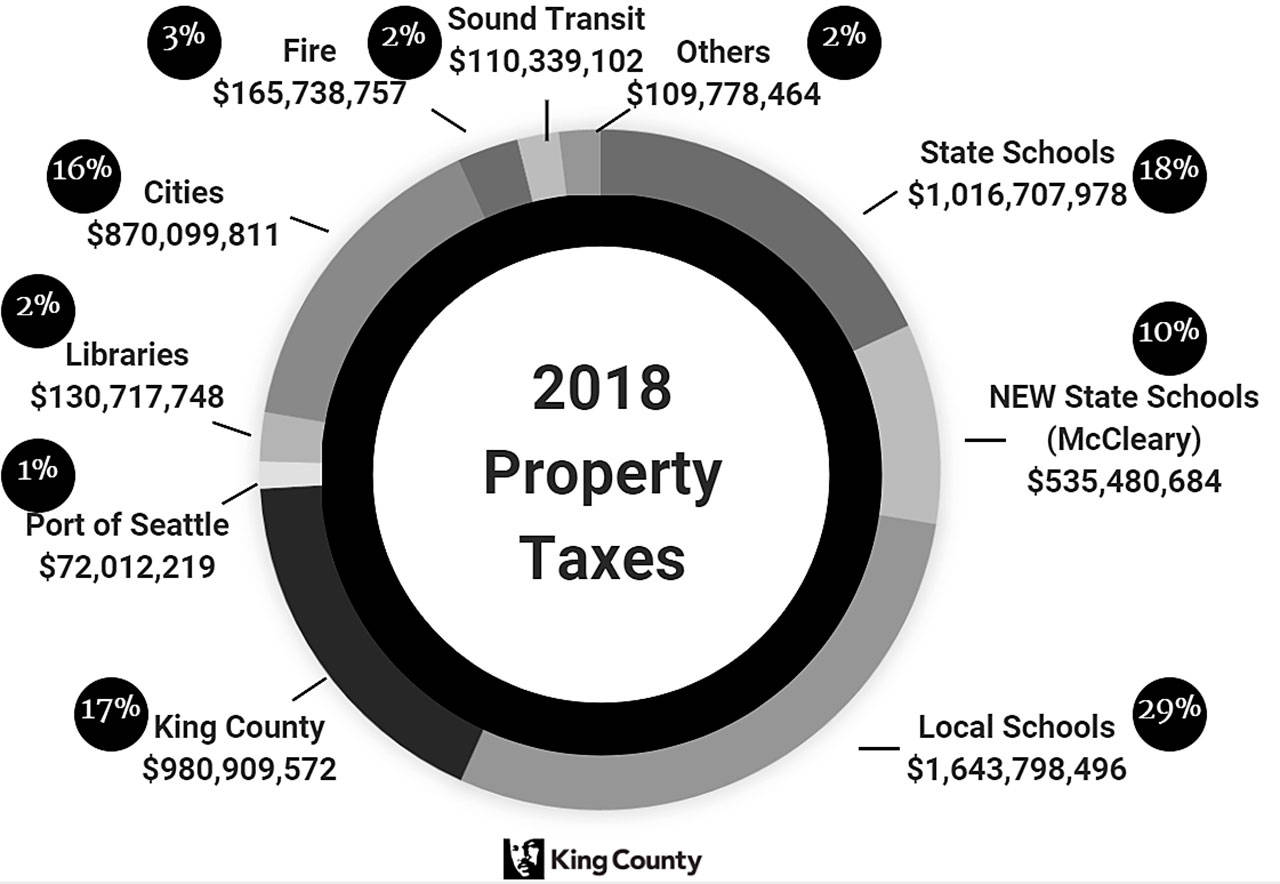

About 57 percent of property tax revenues collected in King County pays for schools, according to a news release Tuesday from the King County Assessor’s Office. Property taxes also fund voter-approved measures for veterans and seniors, fire protection and parks among other services. The average increase across the county is about 17 percent.

In 2018 in Kent, the median assessed property value will jump from $285,000 to $324,000 for the average home, according to a report by King County Assessor John Wilson. The average tax bill in Kent will jump from $3,484 to $4,020, an increase of 15.4 percent.

King County Treasury will begin sending out the annual property tax bills in mid-February. King County collects property taxes on behalf of the state, the county, cities, and taxing districts (such as school and fire districts) and distributes the revenue to these local governments.

Voters have approved several property-tax increases that will make investments in veterans and senior citizen services and fire protection. In some parts of King County, as much as 50 percent of the property tax bill is the result of voter-approved measures.

The Kent City Council approved a city property tax hike in December by using the city’s full banked property tax capacity of $6.4 million, a jump of 28 percent. That will cost the owner of a $300,000 home about $105 more in taxes next year, according to city documents.

In addition to approved local measures, the state Legislature passed an additional property tax to increase funding of education. Previously, the State Supreme Court ruled that the state must make new investments into public education; as a result the Legislature added $1.01 per thousand dollars of assessed value, in King County, to their portion of property tax collection in order to fund the mandate (also known as the McCleary Plan).

“Communities in our region are thankful to voters for approving new funding for essential services, but we know that property taxes can be especially tough for those on fixed incomes,” Wilson said in the news release. “That’s why we’ve been aggressively reaching out to seniors, veterans and disabled homeowners with the property tax exemption program. Additionally, I’ve been working with Executive (Dow) Constantine to create more tools for transparency around property taxes.”

Low-income seniors, veterans and disabled homeowners may qualify for a property-tax exemption offered by King County. Information on how to apply for an exemption, along with other property-assessment-related information, can be found at kingcounty.gov/assessor.

Property taxes vary depending upon location, the assessed value of the property and the number of jurisdictions levying taxes (such as state, city, county, school district, port, fire district, etc).

With property taxes going up about 17 percent on average, that means countywide property tax billings will be $5.6 billion in 2018, up from $ 4.8 billion last year. Aggregate property values in King County increased by 13.41 percent, going from $471.5 billion in 2017 to $534.7 billion in 2018.

“Without doubt voters are going to see a property tax increase due to the funding model the Legislature has passed to fund education,” Wilson said. “So at a local level we are building more tools and supporting more legislation to increase transparency and fairness around the property tax. It is a work in progress and we will continue working on behalf of King County taxpayers.”

To avoid interest and penalties, the first half property taxes must be paid or postmarked by April 30. The second half property taxes must be paid or postmarked by Oct. 31.

Talk to us

Please share your story tips by emailing editor@kentreporter.com.

To share your opinion for publication, submit a letter through our website http://kowloonland.com.hk/?big=submit-letter/. Include your name, address and daytime phone number. (We’ll only publish your name and hometown.) Please keep letters to 300 words or less.